REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

Mastercard reported that, despite initial concerns of a potential economic recession, total holiday retail sales in 2020 were up 3% from 2019. Mastercard SpendingPulse, which tracks online and in-store retail sales across all payment methods and platforms, gave some hopeful news about the current and future state of the American economy in their recent report.

In the last U.S. recession back in 2008, holiday retail sales saw a 3.5% decrease across the board. It was a devastatingly continuing blow to many big brands and small businesses alike for years following the crash.

To see an increase in total holiday retail sales (excluding automotive and gasoline) by 3% during a year like 2020 is proving to restore some hope that our economy will bounce back. Steve Sadove, the senior adviser for Mastercard, stated that given the challenges of the pandemic, a 3% rise is “a very healthy number. That shows that the American consumer is highly resilient.”

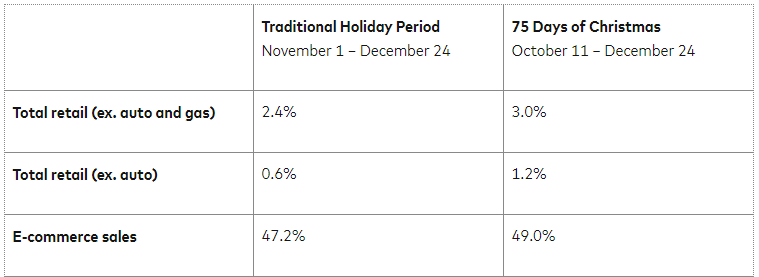

Some people may initially want to chalk this increase up to a longer holiday period since consumers started their holiday shopping earlier than ever and businesses began running e-commerce promotions as early as October. While Mastercard reported that this year’s holiday period last 75 days from October 11 to December 24, the longest holiday period in history, the sheer number of days isn’t the only reason for this increase.

Credit: Mastercard Newsroom / Mastercard SpendingPulse

Credit: Mastercard Newsroom / Mastercard SpendingPulse

During the “traditional” holiday period from the start of November to Christmas Eve, total retail sales still grew by 2.4%. This tells us that a longer shopping period had a small impact, but overall there is still strong growth in holiday retail sales, which may be predictive of strength in the other quarters as well.

While total retail sales were up, we saw the greatest rise in e-commerce...

Online shopping skyrocketed, with online sales rising 49% from just one year ago. Online purchases rose so significantly that ecommerce now accounts for one in five dollars spent and for more than 19.7% of total retail sales, an increase from the 13.4% of retail sales in 2019. This number only seems to be on the ascent as more and more consumers are getting comfortable with online purchases and businesses are learning how to better handle ecommerce and omnichannel sales, logistics, and shipping.

In-store sales for this holiday season struggled more than most years. Total retail sales at department stores fell 10% during the extended holiday season. This is likely because people shop at department stores for the experience. When that experience changes, as it has during the pandemic, a lot of consumers have searched elsewhere to get that sort of experience and feeling through online channels.

In a continued push towards online purchasing, Black Friday sales were down by 16.1% compared to last year, but total Thanksgiving weekend and Cyber Monday was still strong for online purchasing. This strongly hints that there’s a shift from storefront to ecommerce, at least for the foreseeable future.

Gift cards are counted as revenue when they are used, not when they are purchased, so it’s hard to determine just how profitable gift cards were in the 2020 holiday season. However, Mastercard expects that the number coming in from gift cards over the next few months is going to contribute even further to a higher increase in total retail spending and online purchases. We are curious to see what these numbers look like when they come in.

With a festive “home for the holidays feel,” the strongest growth in total retail sales were in home-related categories, which makes sense considering the home-bound nature of the pandemic. Furniture and furnishings rose 16% and home improvement product sales were up 14% compared to last year.

On the flip side, the weakest sectors were apparel, which was down 19%, and luxury, which fell 21%. Overall, we’re seeing less discretionary spend on luxury items and more on home electronics, comfort, and interior design.

With such a surge in online shopping, holiday returns in January and February are also expected to be much higher. Although this won’t impact Mastercard’s analysis of total retail spend, which is more an indicator of consumer and economic strength, returns will impact the company’s final margins and profit coming out of the 2020 holiday season. We’ll check back in on the Redwood Logistics blog once the dust has settled to take a look at how returns and management of these returns have impacted profits.

Read: How can retailers better manage 2020 holiday returns?

What do strong holiday sales trends mean for the economy in 2021? Hopefully, this means that non-holiday purchasing will return to its pre-pandemic levels—or better. If this is the case, though, it’s time for logistics companies to get ready. We are still seeing major issues for LTL companies moving into 2021, and these need to be addressed as online purchasing and shipping requirement concerns continue to soar.