REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

We’re a week into the United Auto Workers (UAW) strike, and little progress has been publicly announced between the two sides. At this point, the UAW has only called for workers to strike at three locations. But there are plans to expand the locations and escalate the pain felt by the Big Three Detroit automakers. The effects are already being felt by the US logistics market. Moving from Detroit to Washington, the US federal government appears to be heading toward a government shutdown as the end of the fiscal year approaches. In more bad news, oil prices are surging. There are some positive developments, though. The Inbound Ocean TEUs Volume Index (IOTI) points to growth in domestic shipping and warehousing. But overall, the short-term picture of freight demand continues to look fairly flat. At the same time, as capacity continues to exit the market, pressure on buy rates will grow. This crossfire of downward pressure on contract rates and upward pressure on spot rates has the potential to cause quite the pinch in the coming months.

Read on for more details on how recent events are impacting the US freight market.

Watch This Week's Redwood Rundown

Each week, the Redwood Rundown showcases expert insights from EVP of Procurement Christopher Thornycroft. Spend just a few minutes with Christopher and you’ll gain a deeper understanding of the news and events impacting your business this week:

The UAW Strike Is Already Taking a Toll

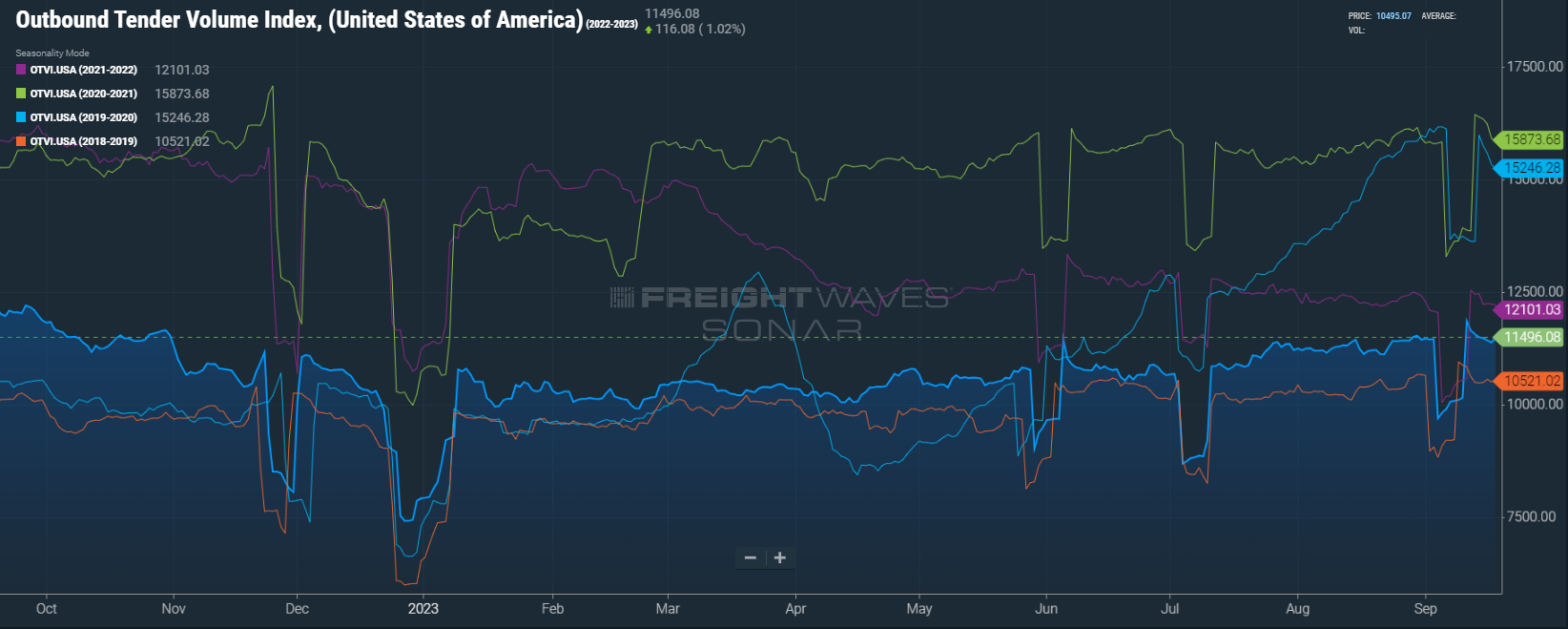

As the UAW strike seems on the verge of escalating to more sites, we’re seeing the impact on the US logistics market. Volume postings have already identified a declining market throughout the Midwest. These volume declines began last Friday, typically a time when the Midwest region is otherwise heading toward its seasonal peak. The larger the strike grows and the longer it takes to resolve, the more weakness we expect to see in volumes, particularly in the Midwest — but also in border cities and other locations. The good news? At least one volume metric remains stronger than anticipated. The Outbound Tender Volume Index (OTVI) — a measure of electronically tendered freight volumes on a given day — has begun recovery and is trending back up, even with the impact of the strike. It remains probable that there will be a legitimate heat-up for the end of the third quarter, which is a regular seasonal event.

Fuel Costs Expected to Rise

To add even further pain for both demand and smaller smaller carriers, oil prices are heading toward $100 a barrel as OPEC production cuts continue. A stronger-than-expected global economy continues to push up the price per barrel. This will present further challenges to the Fed's fight on inflation for 2024. Stay tuned as we watch to see the effect on fuel costs and carrier rates.

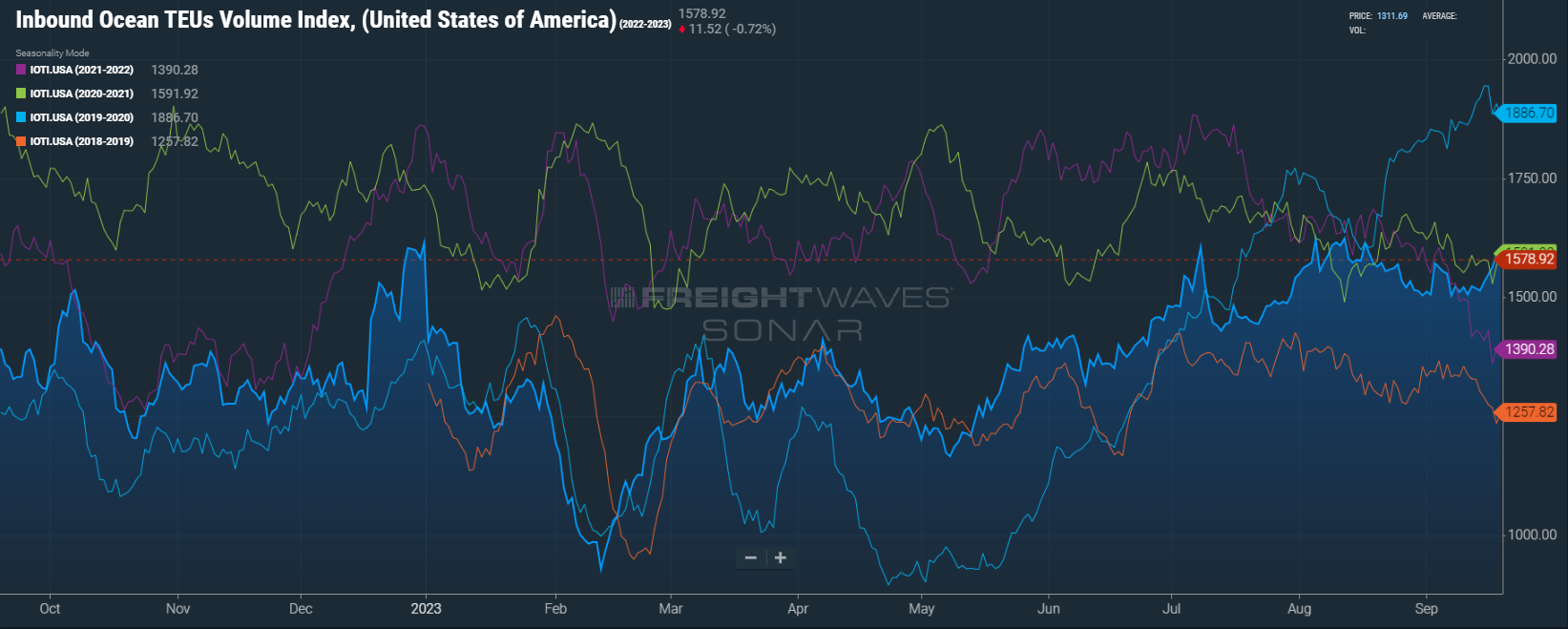

One Bright Spot: A Rising IOTI

There is some positive news coming from the Inbound Ocean TEU's Volume Index (IOTI), which points to the strongest sustained levels since this time last year. The IOTI measures daily bookings or shipping orders for 20-foot equivalent units by estimated time of departure from the ports of origin. It’s a leading indicator of domestic shipping and warehousing activity. What does this mean? We might be seeing the impact of less destocking of inventory. As ACT research notes, less destocking adds to growth in freight volumes.

Capacity Continues to Exit the Market

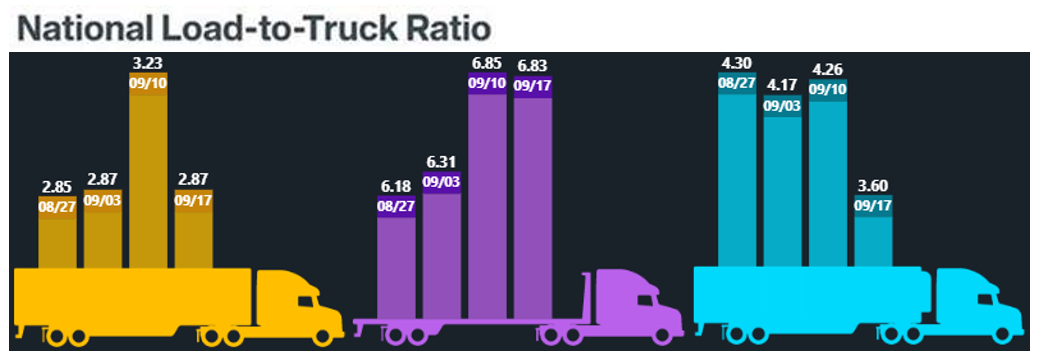

We’ve already seen almost 1,600 carrier authorities leave the market so far in September, after losing 1,443 authorities in August. The rapid pace of capacity reduction is creating a market that’s more vulnerable to spot inflection. We see evidence of a market that’s losing its ability to soak up demand increases. Last week’s DAT load to truck ratio was 2.87 to 1 — we view 3:1 as surpassing equilibrium — without any significant volume pressure. Where we have seen increases in demand, we have immediately seen abrupt shifts from oversupply to undersupply. For example, in the Pacific Northwest, the states of Washington and Oregon have moved from 1.4 LTT to 5.5 LTT over the past month. We’ve also seen the whiplash of seasonality in the state of New York, which has seen tender rejections shoot above 5% as logistics providers feel the pressure of low rates meeting tightened capacity. All of this seems to be a precursor to other markets that will follow in the near future, barring an economic recession that would bring demand once again below the levels of supply.

Top 3 Charts for the Week

The OTVI Shows Growth

Despite the UAW strike, the Outbound Tender Volume Index (OTVI) is on the rise this week.

The IOTI: Another Positive Trend

The Inbound Ocean TEU's Volume Index (IOTI) is showing the strongest sustained levels since this time last year.

DAT National Load-to-Truck Ratio

Last week’s DAT load to truck ratio was 2.87 to 1, without any significant volume pressure.

Data used with permission from DAT Freight & Analytics.

Get Up to Speed with Weekly Market Intel

Want to keep your finger on the pulse of the US logistics market? Follow the Redwood LinkedIn page to get Christopher Thornycroft’s insightful Redwood Rundown video every week. You can also check our insights blog for industry trends and to gain market intel, like the weekly Redwood Report!