REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

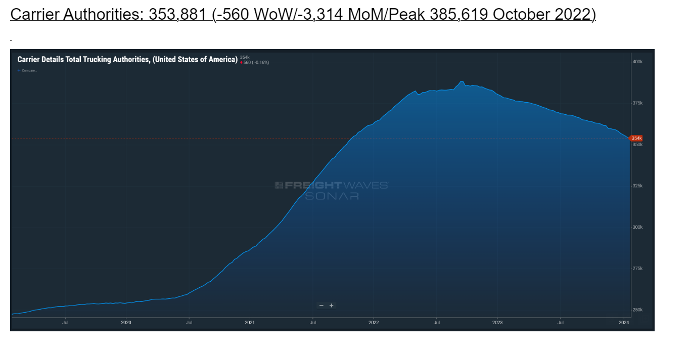

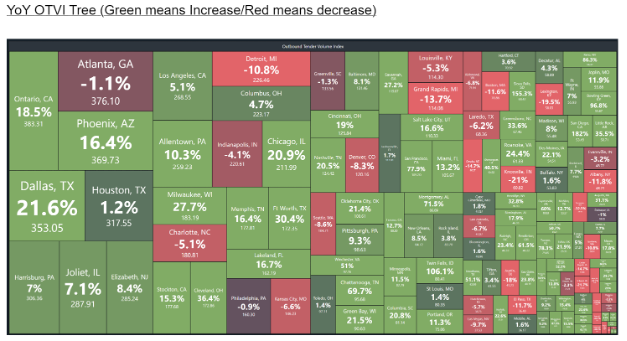

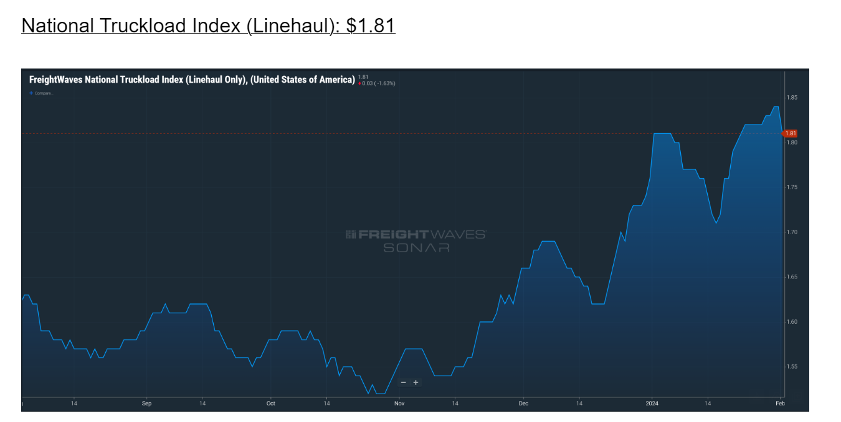

The freight market experienced shocks and tremors in January that shook some routing guides along the way. Whether we look at supply (carrier authorities down -3134 MoM/Long Distance TL Employment down -900 in December), demand (OTVI +10.5% YoY), or rate (DAT Spot LH $1.71, +$.06 MoM, highest since February 2023) we’ve seen the market slowly move. Movement doesn’t mean flip, but underlying conditions have been changing for months now. The cumulative impact of this reduction in capacity, combined with holiday- and weather-related volatility — along with slightly increased demand — has created a higher cost environment than either shippers or brokers experienced previously.

If the conditions of the past few weeks were to remain in place for the duration of February, we’d see spot rates continue to rise and contract freight rejections increase further. However, with low-volume February upon us, it’s more likely that we’ll continue to see underlying capacity conditions deteriorate, while the immediate market sees a lessening of pressure and a decrease in freight volume for the front half of the month. We expect volumes to pick back up and increase during the back half of the month, based on projections of strong import volumes for the second half of February and beginning of March.

We expect this loss of volume to reduce load-to-truck ratios and slow the ascent of spot and contract rates in the short term. A risk of volatility remains in the form of severe weather, but the upcoming forecasts suggest clean highways and little disruption on the immediate radar. With that said, no one has ever based a market forecast on an analysis of the traditionally weak February market. If we feel any bumps in the road, let alone shocks, it should serve as a bellwether for future months that have natural increases in freight volumes.

Read on to learn more, including a closer look at regional dynamics as we kickoff February.

Watch This Week's Redwood Rundown

Each week, the Redwood Rundown showcases expert insights from EVP of Procurement Christopher Thornycroft. Spend just a few minutes with Christopher to gain a deeper understanding of the news and events impacting your business this week:

The Contract-Spot Spread Is Shrinking

Overall conditions continue to act as headwinds, despite the underlying changes we’re sensing in the US freight market.

Carriers are still operating in the red if they’re running in the spot market, and shippers continue to seek contract decreases. But sentiment is changing from previous pricing cycles, which saw a broker/carrier community eager to slash rates in anticipation of continued downturns. Now all parties are confronting the realities of rising costs.

The DAT Contract–Spot spread is down to $.35, the smallest gap we’ve seen since March 2022. This spread isn’t small enough to trigger a full market change, and history suggests the market would have to digest roughly three months of non-holiday induced spot rate increases before the turn would occur. Considering how low spot rates have fallen, it may take still longer than that, especially with significant demand triggers that are difficult to see at this time.

No Interest Rate Cuts — But There Are Some Positive Signs

One demand trigger that appears to be shelved at least until H2 are interest rate cuts. A strong January employment report (353K jobs added in January) suggests the Fed will not be bringing down benchmark interest rates (5.25% - 5.5%) anytime soon as it continues to tackle inflation. Still, there is plenty of good news in that statement, as the economy continues to be healthy enough to be fed its medicine. The Fed rushing to cut interest rates early would be a sign that there’s something in the economy that needs to be saved.

As painful as higher interest rates may be for manufacturing, industrial production, and the housing market, the alternative would likely result in a much more dangerously weakened freight market than the one we’re currently experiencing.

Even in this higher interest rate environment, there are positive signs for the future. The Manufacturing PMI hit a 12-month high of 49.1%, remaining in contraction for the 15th consecutive month, but New Orders (which indicate future production) rose 5.5% MoM to 52.5%, the first time New Orders have entered expansion territory in 16 months. The PMI has registered Customer Inventories at 43.7%, a sharp decrease of -4.4%, indicating that inventories will require future restocking. We won’t see the December Total Business: Inventory to Sales Ratio update until the middle of February. But if you’re the type of person who wants to know if the freight groundhog will see an early spring, that’s the index to watch.

What’s Happening Across the US?

In market specifics, we see a consistent decline in volumes across much of the country — with carrier rates following, albeit at a slower clip. The volume declines are steepest out of Chicago (1.5 to 1) in the Midwest and Kansas City, MO (2.0 to 1) in the Great Plains. Smaller markets in the region such as Cedar Rapids, IA (3.9 to 1) and Green Bay, WI (4.7 to 1) remain relatively cooler compared to just a week ago, but are subject to volatility, particularly later in the day.

Down in the Mid-South, Memphis has faced significant capacity shortages as the deep freeze earlier in January created a backlog of freight, pushing intermodal volume into truckload. While most of this volume was created from the freeze, Memphis typically remains a stronger market through at least the middle of February. We forecast loosening in Texas, with the exception of border markets. McAllen (11.9 to 1) and Laredo (2.1 to 1) are expecting produce imports (think Super Bowl avocados) from Mexico to start this week.

The Northeast was the tightest market in the country, with imports staying strong out of Baltimore, MD (5.4 to 1) and Elizabeth, NJ (5.1 to 1) while impacting inland capacity in markets such as Harrisburg, PA (4.6 to 1). However, we expect these markets will cool drastically very soon, provided there are no winter-weather disruptions.

In the Southeast, volumes have been relatively stubborn in what should be a declining market with Atlanta (2.2 to 1) still seeing strong WoW volume comparisons. In South Florida, Miami’s temp-control load-to-truck ratio spiked to 9.5 to 1 on Friday as flower imports hit the area ahead of Valentine’s Day. It will continue to remain elevated for the first half of February.

On the West Coast, volumes continue to fall from Los Angeles (1.9 to 1) to San Francisco (1.8 to 1) up into the Pac Northwest markets of Portland (1.2 to 1) and Seattle (0.6 to 1). Inbound West Coast freight will continue to see rates rise, as carriers outbound from the region see rates fall. Carriers will look to avoid the region at all costs, despite an expected overall declining market in February.

Top 3 Charts for the Week

1) The Winds of Change Continue

As stated in previous Redwood Reports, we can’t ignore the continued exit of capacity. Carrier authorities were down by 3134 month-over-month, while long-distance truckload employment was down by 900 in December.

2) Demand Is Up Across the Country

The Outbound Tender Volume Index (OTVI) is up by 10.5% year-over-year, with volumes generally increasing across the US.

3) Spot Rates Are Approaching Contract Rates

Spot rates are up $.06 month-over-month, with just a $.35 difference between spot and carrier rates.

Get Up to Speed with Weekly Market Intel

What’s going on this week in the US logistics market? Follow the Redwood LinkedIn page to watch Christopher Thornycroft’s insightful Redwood Rundown video every week. You can also read our insights blog to learn about industry trends and gain intel, including the weekly Redwood Report!