REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

As predicted in previous reports, we’re now in the middle of the low-volume February decline.

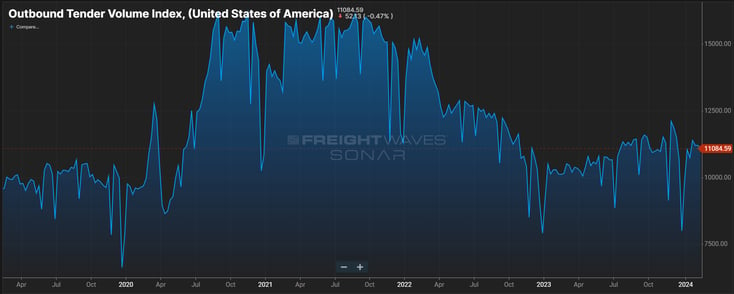

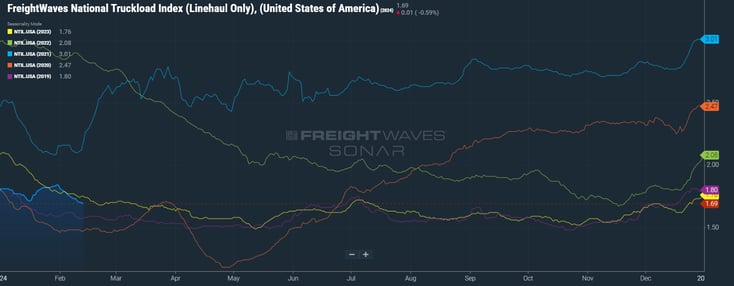

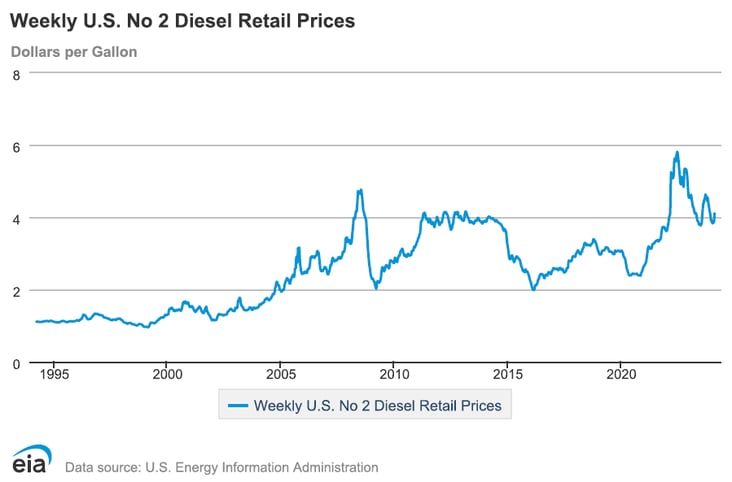

The OTVI (Outbound Tender Volume Index) is lower than it has been since the United Auto Workers strike (9/15/23 – 10/30/23) impacted freight volumes. This decline in freight volumes has coincided with a painful one to two weeks of declining rates. The SONAR NTIL (National Truckload Index – Linehaul) has dropped $.17 since the beginning of the month, while diesel fuel prices increased $.21 week-over-week, rising to over $4 a mile, at $4.109. This represents the largest jump in diesel fuel prices since the $.22 cent increase in the last week of July 2023.

Losing revenue, while increasing costs, is a math equation that will accelerate capacity exits. Carriers who may have been emboldened by January’s volatility now must confront Q1 realities that reflect still-limited demand levels.

Keep reading to learn more — including a look at how regional dynamics are driving an interesting trend in lower-volume markets.

Watch This Week's Redwood Rundown

Posted weekly, the Redwood Rundown showcases insights from Redwood’s resident expert, EVP of Procurement Christopher Thornycroft. Spend just a few minutes with Christopher to gain a deeper understanding of the events impacting your business this week:

Rising Inflation, Lower Housing Starts Keep Volumes Low

There are signs that the underlying conditions for 2024 are positive compared to 2023 — including year-over-year (YoY) increases in OTRI, OTVI and import volumes.

But major sectors of the freight market remain dormant, particularly the housing market. January’s seasonally adjusted new privately owned housing unit starts reflect an annualized rate of 1.33M — the second-lowest annualized rate since July 2020.

While January weather was at least partly to blame for last month’s drop in housing starts, the largest impact remains interest rates. These rates don’t appear to be coming down anytime soon, coming off the heels of yet another strong jobs report (+353K jobs added in January) pitted against stubborn inflation (January CPI report +3.1% YoY and over the projected 2.9% increase/core inflation +3.9%).

Until significant improvement is seen in curbing inflation, interest rate cuts will be pushed off — and, if interest rate cuts are pushed off, there will be a lid on the housing market.

Will the February Blues Last Through Mid-April?

Overall, there’s a belief that the freight market is feeling the effects of a “soft landing.” However, the timetable for getting this plane back in the air is unknown.

Right now, it looks like roughly mid-April should see the beginning of the hotly debated inventory re-stock, which has the potential to provide a Q2 bump in freight volumes. However, this would come after significantly more capacity is removed from the market.

While no carriers want to end up as “removed capacity,” the reality of the costs of renewing licensing and registration fees will undoubtedly shelve trucks and drivers before we see a projected seasonal volume turn.

As others have said, this would leave the market vulnerable to typical shocks like CVSA’s Road Check event on May 14-16, as well as unplanned events such as weather and geopolitical developments.

Until then, however, it’s the February blues. We anticipate the contract/spot spread to expand again, after shrinking down to $.35 in January, leading to contract freight being accepted to a greater degree while shippers prepare their Q2 bids.

A Look at Regional Dynamics — and a Surprising 2024 Trend

In market specifics, we’re looking at very loose capacity throughout much of the country. In the Midwest, volumes have fallen off a cliff. This is led by Chicago (0.6 to 1), with smaller regional markets such as Green Bay, WI (1.3 to 1) and Columbus, OH (1.4 to 1) closely following suit. We would not anticipate much in terms of capacity challenges until we get closer to the end of Q1.

The same can be said of the East Coast, with the seasonal surge well past its peak in markets such as Elizabeth, NJ (2.3 to 1), Baltimore, MD (2.1 to 1) and Harrisburg, PA (1.6 to 1).

In the Southeast, volumes and rates have cooled since the pre-Valentine’s push that occurred out of South Florida, and we expect this market to cool rapidly until produce season begins in March. Otherwise, the region has remained in its trough, with capacity in markets such as Atlanta (2.1 to 1) looking to get out of the region. In smaller-volume markets such as Alabama and Mississippi, however, we anticipate at least some tightening.

In the Mid-South, we see Dallas (1.0 to 1) and Houston (2.5 to 1) with flat volumes to begin the month and no shortage of capacity in the border markets of Laredo (1.5 to 1) or El Paso (0.8 to 1). However, the Texas market typically starts to gradually heat back up beginning the third week of February, and we expect volumes to rise next week, albeit against still-ample capacity.

On the West Coast, volumes continue to search for their floor as the region is well into its dead season — from Los Angeles (1.1 to 1) and Phoenix (1.0 to 1) up into the Pacific Northwest markets of Seattle (0.6 to 1) and Portland (1.2 to 1). The only corridors we see in this market with rates staying strong are long-haul freight heading into the West Coast, as carriers will continue to look to avoid the region with collapsing volumes.

One development we’ve noticed so far in 2024 is the impact of low-volume outbound markets on carrier load planning. This year, lower-volume markets have been significantly more difficult to find capacity out of than in previous years. There appears to be a natural reluctance to position equipment in areas where healthy return hauls are difficult to find.

This has left plenty of low-volume markets more expensive to source capacity from than in years past, which is an inverse of the traditional volume/capacity/price relationship — where low-volume areas would traditionally be characterized by aggressive pricing, as carriers looked to take any return load they could get. But this year carriers have not positioned themselves into these low-volume markets, leaving these markets with less capacity to source from — and increasing rates out of those markets. This could just be a Q1 trend, or we could be seeing an early impact of a market with considerably less capacity than last year. We’ll keep watching this new development closely.

Top 3 Charts for the Week

The OTVI Continues to Drop

The OTVI (Outbound Tender Volume Index) has reached its lowest level since the UAW strike last fall.

SONAR’s NTIL Is Also Declining

Also dropping? The SONAR NTIL (National Truckload Index – Linehaul) has declined by $.17 since the beginning of February.

Diesel Fuel Tops $4.00/Gallon

Diesel fuel prices have reached $4.109 per gallon, increasing $.21 week-over-week. This is the sharpest jump in fuel prices since last July.

Get Up to Speed with Weekly Market Intel

Follow the Redwood LinkedIn page and gain critical insights by watching Christopher Thornycroft’s Redwood Rundown video every Tuesday. And check out our insights blog to access the weekly Redwood Report and other news updates!