REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

We’re getting the Redwood Report out late, after a busy week dealing with the anticipated difficulty in the market, stemming from driver repositioning and absenteeism. Let’s take a quick look at what’s been happening, and what’s to come.

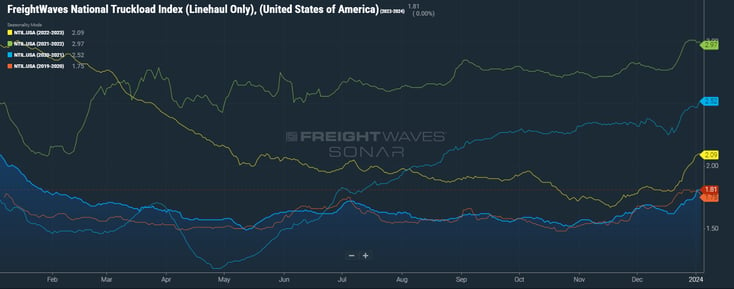

The holiday market may be winding down, but as we write this it’s been five consecutive days that we’ve seen the SONAR NTIL (National Truckload Index Linehaul) hold at $1.81 — which represents a +10% increase in rates from mid-December. This is something to watch going forward as there’s more pressure in the market than we’ve seen for a full calendar year. In addition, a small increase in tender rejections is driving some growth in the spot freight market. Orthodox Christmas on January 7 will take drivers off the road and may further tighten capacity, while imports are picking up steam ahead of Lunar New Year on February 10. History tells us the market will be cooling again by the third week in January, but we’ll keep you informed.

Continuing carrier exits have brought the total number of drivers to its lowest level since June 2022 — but the market still has excess capacity. February typically brings the kind of cool market that every carrier and freight broker fears. Barring severe weather that impacts major routes, we’ll see traditional levels of market softness next month, once we get past the Lunar New Year push.

Keep reading to learn more about the forces impacting the logistics market as we kick off the new year, including a look at regional dynamics.

We’ll talk to everyone much earlier next week, and we hope you enjoyed the holidays.

Watch This Week's Redwood Rundown

Posted weekly, the Redwood Rundown showcases insights from Redwood’s resident expert, EVP of Procurement Christopher Thornycroft. Spend just a few minutes with Christopher to gain a deeper understanding of the events impacting your business this week:

The Market Is Cooling, But Watch for Some Growth Spikes

We’ve already discussed the fact that the SONAR NTIL (National Truckload Index Linehaul) has held at $1.81 for five days, which is a +10% increase in rates from mid-December. Perhaps this occurred because the force of cost pressures did not reach past years, but the total lack of downward movement in rates is something to watch going forward. If carriers are holding their ground on rates against what has been a soft demand environment to open the year, there is the suggestion that any pickup in demand may come with an accompanying unseasonal rate push. Stay tuned.

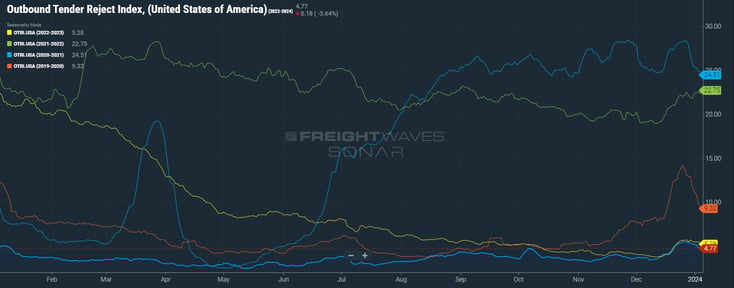

Overall, there’s been more pressure felt in the market than we’ve seen for a full calendar year. The Outbound Tender Reject Index (OTRI) reached a peak of 5.60% on December 26, and it stands at the time of writing at 4.55%. Redwood’s own tracking of load-to-truck ratios reveals that major markets were tighter last week than at any time in 2023, other than the first week of the year and the week after Thanksgiving. The small increase in tender rejections has created a meaningful push for spot freight quotes, with many landing with far less lead time than in prior months, creating even more urgency for teams and reefers. Again, seasonally, we generally see the freight market first see a volume increase to pre-holiday volumes as shippers fully come back online, and then we see the market cool by roughly the third week of January.

There are still obstacles remaining in the month, with Orthodox Christmas (Sunday January 7th) keeping some drivers home on Monday, January 8, before coming back on the road Tuesday or Wednesday. This will challenge Chicago’s capacity and make load recoveries significantly more difficult. With the amount of capacity that the Chicago market brings to the country, this effect should not be underestimated.

Excess Capacity Remains, Even as Carrier Exits Accelerate

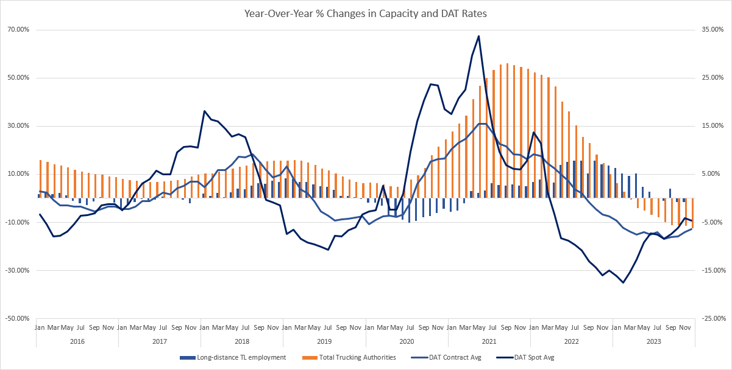

Carriers have continued to leave the market, and this is showing up in both the exits of carrier authorities — think owner-operators and smaller fleets — as well as jobs lost from general freight, long-distance truckload. The market lost roughly 23,000 net authorities in 2023, with ~25% of those capacity exits in November and December. In other words, capacity exits are speeding up.

At the same time, today’s employment numbers reveal a loss of 2,000 long-distance truckload jobs in November, bringing this population down to its lowest level since September 2022. (We should note that September 2022’s data has long appeared to require a correction, so we believe this is the lowest number of drivers employed in this sector since June 2022.) Despite this, excess capacity remains in the market — provided those trucks are on the road and properly positioned — and it will take even more carrier exits to see sustained capacity shortages.

Looking ahead to the first quarter of 2024, we expect to see excess capacity over the current level of demand. There are some positives in the market in the form of stronger-than-usual seasonal imports ahead of the late Lunar New Year (February 10 this year), as well as economic optimism as the Fed’s “soft landing” appears to finally be realistic. But a “soft landing” still implies that the economy will descend to a low before rising again. We expect to see the projected “soft landing” materialize in the form of a weak Q1.

That weakness in Q1 might have a silver lining, as it would likely signal to the Fed that it had appropriately cooled the economy, spurring interest rate cuts in Q2 2024. If those interest rate cuts occur, that would have the potential to rev up the housing market, which has already shown signs of life, with New Privately Owned Housing Units up 14.8% MoM in November. The manufacturing sector could also be positively impacted (the Manufacturing Purchasing Managers' Index, or PMI, was at 47.4% in December). Both these industries are essential to the creation of freight demand. If we see inventory restocking in Q2 as well, we could experience a stronger demand environment than currently anticipated.

Expect a Chilly February

While Q2 looks promising, we don’t anticipate any pickup in demand in February. The short-term demand push ahead of Lunar New Year should cool off immediately after February 10. February is typically a month that freight brokers and carriers dread because it brings soft market conditions — and this year should be no exception. But severe weather patterns are always an issue during the winter season. We’re watching closely as major storms appear to be forming, but we’re not seeing anything that’s likely to close I-95. That’s the country’s most traveled road, linking the northern and southern states along the East Coast, and it’s the most important artery for North-South and South-North freight traffic.

What’s Happening Regionally?

In market specifics, we’ve seen repositioning over the last couple of weeks severely impact available capacity. Kansas City (7.3 to 1 as we write this) has seen the most pain, along with the rest of the Great Plains from Fayetteville, AR (14.4 to 1) to Cedar Rapids, IA (4.8 to 1). From Chicago (1.7 to 1) through Wisconsin (Milwaukee 4.1 to 1, Green Bay 8.1 to 1) and down to Indianapolis (3.9 to 1), the Midwest has felt the impacts of repositioned capacity as well — with the carrier population out of Chicago taking advantage of the situation. This year, Orthodox Christmas was celebrated on January 7, which will impact capacity throughout Chicagoland this week. Similarly, over in the Northeast, load-to-truck ratios have risen from Elizabeth, NJ (5.0 to 1) to Buffalo, NY (5.9 to 1), as well as Harrisburg, PA (7.8 to 1) and Baltimore, MD (6.0 to 1). The expected snow and ice over the weekend through the I-95 corridor will continue to cause disruptions throughout the week. Down in the Southeast, we’ve seen load-to-truck ratios rise as well, which is typical for the region in the first week of January. But look for a return to mid-December levels quickly, as volumes remain in their seasonal lull until Valentine’s Day. Out West, we’ve seen volatility in the mountain markets of Denver, CO (6.0 to 1) and Salt Lake City, UT (5.2 to 1), with no easy ability to deadhead when capacity gets tight. The Southwest has been flat over the last week. The Los Angeles market is seasonally strong at 2.6 to 1, considering this is the time of the year that market is falling quickly. The Pacific Northwest is in its seasonal lull for dry van transport (Seattle, WA 0.4 to 1) while temperature-controlled freight remains tighter to the east (Twin Falls, ID 19 to 1).

Top 3 Charts for the Week

NTIL Shows Surprising Strength

During the first week of January, the SONAR NTIL (National Truckload Index Linehaul) showed a +10% increase in rates compared to mid-December.

The Spot Market Sees Some Growth

We’ve seen some growth in spot markets, as the Outbound Tender Reject Index (OTRI) reached a peak of 5.60% on December 26 and remains high as we write this.

Carrier Exits Accelerate, with Little Effect on Capacity

Accelerating carrier exits have contributed to the lowest trucking employment numbers since 2022, but excess capacity remains in the market.

Get Up to Speed with Weekly Market Intel

What’s going on this week in the US logistics market? Follow the Redwood LinkedIn page to watch Christopher Thornycroft’s insightful Redwood Rundown video every Tuesday. You can also read our insights blog to learn about industry trends and gain intel, including the weekly Redwood Report!