REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

In the February 22 edition of the Redwood Report, we projected a volume increase for February end-of-month (EOM), a prediction that held true. At the end of February, Contract Load Accepted Volume – Dry Van freight reached its highest level since December 10, 2023, representing an increase of 8% year-over-year (YoY).

However, we also projected that volume decreases would begin roughly on March 7. We’re observing this happen live in the moment, as the Outbound Tender Volume Index (OTVI) dropped earlier this week.

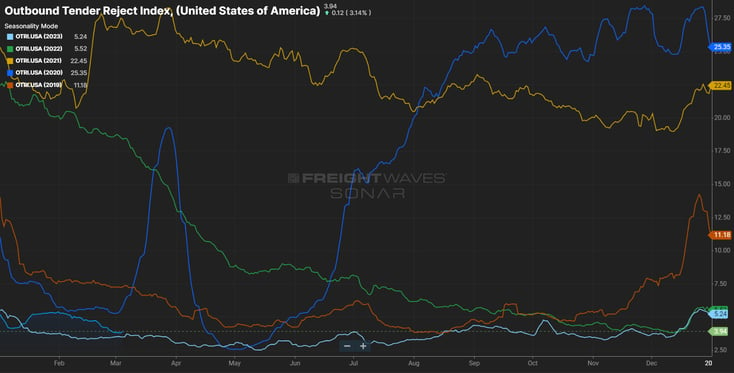

By our estimates, there should be a return to production under way at factories in China, which means that the next push of imports is forecasted to arrive near the first week of April. Currently, we’re seeing Intermodal (IMDL) absorb roughly 12.5% more freight than last year, so even import pushes have headwinds for dry van freight volumes. This is reflected in Van Outbound Tender Rejections, which are standing at 3.69% currently — roughly where they were around December 13, 2023, and in line with March 2023 levels.

Overall, the picture being painted for March looks challenging for freight volumes, particularly spot freight, as shippers will be sending their recently awarded contract freight to high service providers, with less being sent to the spot market for savings. High-volume markets look like the most oversupplied markets right now. The Chicago, Dallas, Atlanta and larger North East markets currently look to be the most oversupplied markets. Plenty of smaller carriers are reluctant to leave a market before what they feel will be the next turn. They felt empowered through December and January, when spot rates trended up — before crashing back down in February to $1.61 before fuel (the lowest spot rates we’ve seen November).

All signs point to a difficult March for carriers, with little help in sight until renewed import levels come into play.

Keep reading to learn more about the forces impacting the logistics market as we kick off a chilly March.

Watch This Week's Redwood Rundown

Posted weekly, the Redwood Rundown showcases insights from Redwood’s resident expert, EVP of Procurement Christopher Thornycroft. Spend just a few minutes with Christopher to gain a deeper understanding of the events impacting your business this week:

Will Carrier Exits Drive a Capacity Correction?

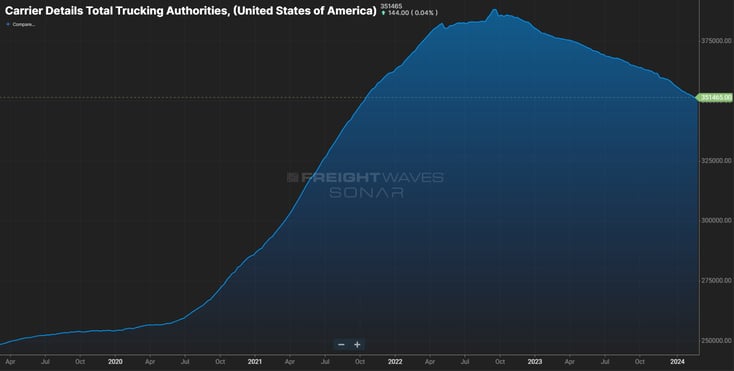

There was a contraction of -2,560 carrier authorities in February, and the number of carrier authorities currently stands at 351,465 — the lowest level since mid-October 2021. However, the average OTVI in October 2021 was 15,267, which is +28% higher than February 2024.

Our current imbalance of supply and demand is likely to continue until a larger volume of capacity is removed from the market, and/or we see demand-driven market change. With the Fed still attempting to get inflation under control, interest rates are not being cut anytime soon — which is probably a good sign of the overall strength of the American economy and should not be viewed entirely as a negative. But it’s created a natural lid on the housing market. An active housing market would fuel freight volumes, but that’s currently a long way off.

Another sector that could jump-start the freight economy is manufacturing, which reported its 16th month of contraction, with the February PMI dropping -1.3% to 47.8%, including New Orders dropping below January’s expansion at 49.2% (-3.3% month-over-month). However, Inventories and Customer Inventories remain in contraction, which creates the potential for another rise in New Orders.

Market Specifics: No Surprises Here

Not much can be said regarding market specifics. As stated previously, the freight market holds ample capacity in almost all points on the map, and the major-market average for last week dropped all the way to 1.2 to 1. Only Shreveport, LA (7 to 1), Memphis (4 to 1) and the Arkansas markets (Little Rock 3.4/Fayetteville 3.3) show any real strength this week.

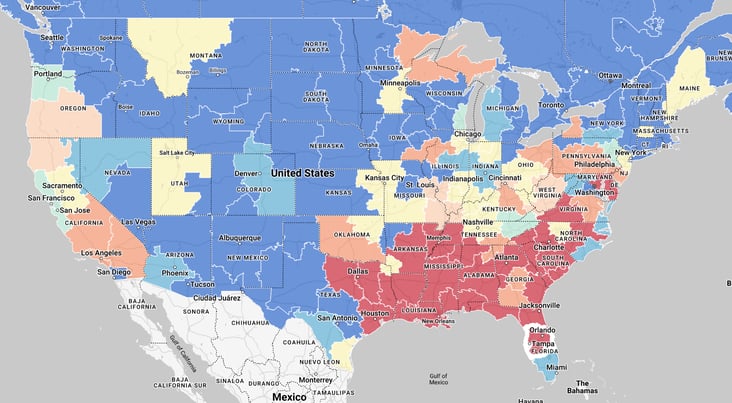

The only other note is that flatbed is seeing a very sharp bump in tender rejections, up to 19.31% this week, which represents a +8.67% change in the last two weeks. However, that market is so fragmented that it remains difficult to fully capture in metrics. A look at the DAT Market Conditions map, however, reveals significant flatbed tightness in the Mid South and Southeast. If this mode is experiencing these challenges without a strong housing market, then future challenges to the mode could be extreme. It’s something to keep an eye on.

We should also note that Ramadan begins the evening of Sunday, March 10, and continues through Tuesday, April 9. While we don’t anticipate this holiday to impact overall capacity levels, there are products that will see less driver availability during this time, such as alcohol and pork.

Clearer Skies Ahead?

Again, as we stated in the last Redwood Report, we expect to see a bit of a slog through March. With the end of the quarter lining up with Good Friday on March 29 — which traditionally sees a large decrease of freight volumes — as well as Easter Sunday on March 31, typical freight volumes during this period are likely to roll over to the first week of April.

It will be a tough month for carriers, particularly smaller carriers, as larger carriers have largely locked up and accepted their current contract rates — presumably at levels at which they can continue to profitably operate.

Within a week, we’ll have a clearer picture of the changes to Long Distance Truckload Employment that took place in January, as well as more information about early April freight volumes as we begin inching toward Q2, potential restocking, produce season and CVSA’s International Roadcheck on May 14-16. All these events have the potential to dramatically shift the landscape we’re currently looking at.

Top 3 Charts for the Week

The OTRI Is Falling Off

The OTRI (Outbound Tender Rejection Index) is dropping, just one sign of the volumes declines we expect to see in March

Carriers Continue to Exit

Carrier exits are still happening — but not yet at a pace that’s going to correct the market’s overcapacity.

Regionally, Flatbed Capacity Is Tight

Even in the current loose market, we’re seeing some regional tightness in flatbed capacity. This is a trend to watch.

Get Up to Speed with Weekly Market Intel

Follow the Redwood LinkedIn page and gain critical insights by watching Christopher Thornycroft’s Redwood Rundown video every Tuesday. And check out our insights blog to access the weekly Redwood Report and other news updates!