REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

Seasonality is the story so far in 2024. We had weather and post-holiday induced pressures in the front half of January, followed by a cool February. Now we’re seeing a market with slightly higher freight volumes, yet downward pressure on the spot market due to contract load acceptance — particularly with awards going live in Q2 and a higher degree of scrutiny from shippers on acceptance and service. Prior to the COVID-19 pandemic, a freight broker could set their watch to this pattern, and it would hit every year. If a return to seasonality is at least part of the story, then here’s a look at what the next couple of months will hold.

The back half of March will see incremental capacity tightening. Historically, this has been particularly noticeable in Gulf Coast markets, including Louisiana and Alabama, along with nearby inland states Arkansas and Missouri. Illinois has traditionally seen tightening, and California and Arizona see end-of-Q1 volume pushes. We’ll begin to see border-crossing freight pick up, with produce volumes growing in McAllen and Laredo, before more produce begins to move the market in mid-April. Given that the end of Q1 falls on Good Friday, we anticipate most of the volume push to run from Monday, March 25, through Thursday, March 28.

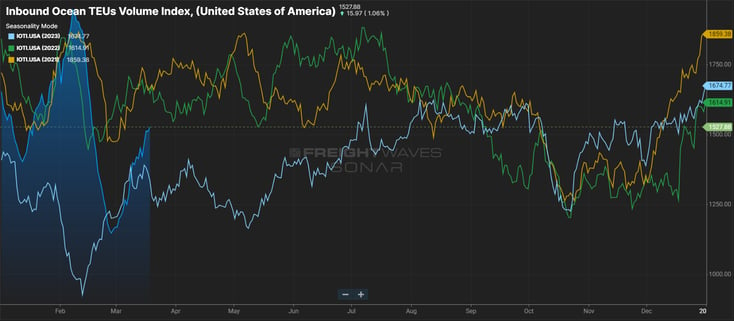

April doesn’t look like it will have a restocking push early, as the Inbound Ocean TEUs Index (IOTI) remains below 1600. That means our 30-day import volume outlook is not strong. We would anticipate the IOTI to continue to rise. We’re targeting May for restock freight volumes, though the recent inventory-to-sales ratio report which shows the inventory to sales ratio expanding from 1.37:1 in December to 1.39 in January, somewhat dampens that outlook. This appears to be driven not by increasing inventories, but by slowed sales as January sales dipped by -1.3% from December. How much of this was caused by inclement weather and how much was caused by the holiday hangover remains unknown at this time. April is usually a softer month, as we have seen month-over-month (MoM) reductions in spot rates in 7 of the last 9 Aprils, and the OTVI has declined in every April since 2018.

The front half of May is traditionally fair soft, and should follow the April pattern until we reach CVSA’s International Roadcheck on May 14-16, which will create service failure pain as owner-operators sit the week out, creating a massive short-term capacity crunch. How much this event bleeds into the Memorial Day holiday market still hinges on demand. But, even in a low-demand environment, the Roadcheck creates significant pain for all parties.

Read on to learn about some of the other trends affecting the US logistics market this week.

Watch This Week's Redwood Rundown

Want to take a quick look at the events and trends that will affect your business this week? Watch the Redwood Rundown, where EVP of Procurement Christopher Thornycroft provides his expert insights:

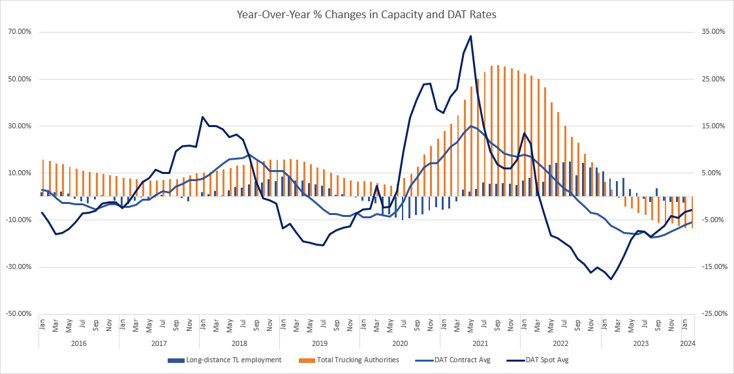

Employment Continues to Fall

Employment data was released earlier this month that reflects lower payroll numbers for enterprise-level carriers. January data from the Bureau of Labor Statistics (BLS) revealed a month-over-month drop of 1,500 long-distance truckload jobs. Now standing at 544,300, long-haul employment is down 8,900 drivers since the all-time high in May 2023.

The last time we saw employment numbers this low for enterprise-level carriers was May 2022, shortly after the Russian invasion of Ukraine and record-high diesel prices pushed owner-operators to the safety of larger fleets. Now, nearly two years later, we see a rapidly shrinking tendency for carriers to replace drivers leaving their fleets, as shippers push for further concessions on contract pricing — and diesel prices remain relatively high compared to the period before the Russian invasion of Ukraine.

Some Warming Trends in the South

In market specifics, we’re seeing the southern half of the country begin to heat up. Beginning in the Mid-South, Houston and the surrounding markets have seen the most substantial capacity crunch this month, impacting available capacity from Dallas through Arkansas and Memphis. Over in the Southwest, we see Los Angeles begin to tighten up, particularly on Fridays. This will be a market that has a true capacity crunch next week as we head into the end of the quarter. In the Southeast, the region is still a month from heavy produce volumes, but we’ve seen early issues with Friday temperature-controlled capacity in south Florida.

Largely, the rest of the country remains a shipper’s market that’s flush with capacity. Barring south Florida, the Southeast represents a shipper’s market where carriers fight for available spot freight. The Northeast continues to see spot volumes fall, forcing available capacity to continue to push rates downward. The Midwest tells the same story as the Northeast, as spot boards continue to dry up, pushing carrier pricing to new lows each week. The Mountain and Pacific Northwest markets have dealt with late-winter weather this month, but have remained backhaul markets as carriers can’t lose out on any available freight in the area.

Top 3 Charts for the Week

The IOTI Remains Below 1600

At 1527, the Inbound Ocean TEUs Index (IOTI) isn’t pointing toward a strong 30-day import volume outlook.

Excess Capacity Continues

In much of the country, a mismatch between supply and demand is creating excess capacity.

Rates Continue Their Decline

Driven by that excess capacity, rates continue their descent in most markets.

Get Up to Speed with Weekly Market Intel

Learn about the market trends impacting your business by following the Redwood LinkedIn page to catch our Redwood Rundown videos on Tuesdays. And keep monitoring our insights blog for these weekly deep dives!