REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

With this edition of the Redwood Report, we’re debuting a slightly new format. We hope you enjoy it. Send us your feedback, share this with everyone, and have a great week!

This Week’s Big Story: The Port of Baltimore Tragedy

This week, the major story is the tragic disaster at the Port of Baltimore in which the Francis Scott Key Bridge was destroyed, effectively closing vessel traffic in and out of the port for a yet undetermined time.

As we post this, the Port of Baltimore remains closed, with no official estimates yet for reopening. We’ve heard intel that diversions to the Port of NYC/NJ will take place, and we’re already seeing spot market prices rising for 40-foot containers inbound from the origin cities of Antwerp, Belgium — the second-largest shipping port in Europe — and Genova, Italy.

The Port of Philadelphia has been discussed as well, and we have seen an 8% increase in twenty-foot equivalent units (TEUs) booked to this port. Savannah, Georgia, has been mentioned as a potential adjusted destination, but it lacks rail service to the north. Anything sent to Savannah would require the use of truckload transportation.

As far as market impact goes, the bridge collapse has not caused much of a market change at this time. The port closure will create a larger issue if diversions to the South add volume during produce season. The Vidalia onion packing date has been established as May 17, which marks the unofficial start date of the spread of produce season north into Georgia.

We’ll continue to share more information as we have it. Jeff Leppert, Redwood’s EVP of Modal Operations, has been doing an incredible job staying on top of this. You can read some of his thoughts here: https://www.freightwaves.com/news/baltimore-bridge-collapse-may-cost-billions-dramatically-disrupt-supply-chains

Demand Trends for this Week

As expected, the end of the first quarter was softened by the timing of the Easter holiday. With Good Friday falling on March 29, little to no pressure was felt in the market, as evidenced by Outbound Tender Rejection Index

(OTRI) staying below 4%.

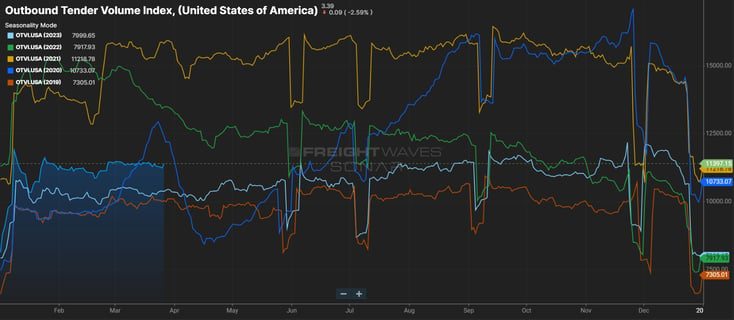

Freight volumes, as reflected in the Outbound Tender Volume Index (OTVI),

have increased year-over-year (YoY) by almost 9%, standing at 11,249. This is stronger than both 2019’s and 2023’s values. However, a larger share of that freight is being moved by rail in 2024 than last year, and that’s continuing to take some of the volume from truckload transportation.

Significant inventory restocking is not yet showing up in the numbers. We continue to watch the Inbound Ocean Volume Index (IOVI) waiting for it to break 1600, which would signify strong — but not overly strong — import volumes. We’ve seen that number stay above 1500 for the last week, but it hasn’t broken 1600 since the Lunar New Year. Right now, it looks like we’re seeing modest restocking. This is helping to fuel the modest freight volume gain we see YoY, which has not yet translated into rates.

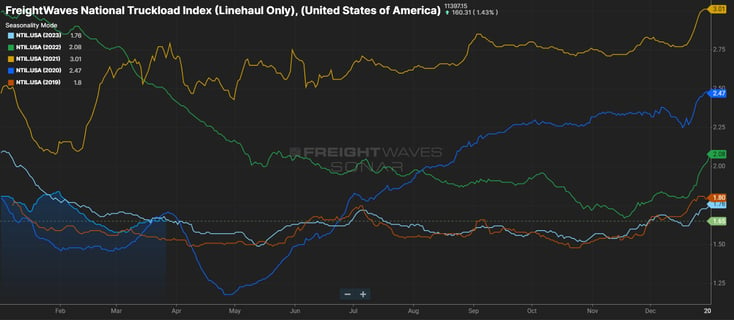

The National Truckload Index for Linehaul (NTIL) has been at or near $1.65 since March 13; this is pretty much flat YoY. Since April is typically softer, we anticipate this dropping in the coming weeks as volume decreases force an even more aggressive approach to the spot market, driving prices further down.

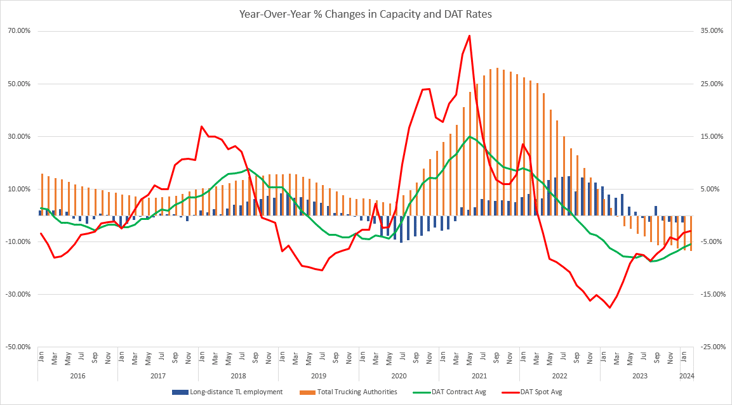

The DAT Contract to Spot spread, an important barometer for the market, appears to have slightly widened in March to +.46 based on spot rate declines from February. An expanding Contract to Spot spread points to a longer delay in carriers regaining pricing control.

One potential change we’re seeing in the market is the housing industry. Inventories remain extremely low, and New Privately Owned Housing Starts rose 10.7% month-over-month (MoM) and 5.9% YoY. The housing market is one of the largest drivers of the freight market — not just for the multimodal freight volumes it generates from start to completion, but also for the competition created for employees who may otherwise drive trucks. Essentially a strong housing market is a double dip. Drivers are pulled away from the life of long-haul trucking and into closer-to-home construction jobs, while freight volumes are boosted. If this trend continues, we could have another demand driver on the board for the construction season

Supply Trends for this Week

Somewhat surprisingly — or even suspiciously — the number of carrier authorities stayed flat for all of March, after freefalling since October 2022 at an average net removal of about -2,100 authorities per month. While the number of carrier authorities is an inherently flawed statistic, it’s been useful for determining the impact of the freight recession on capacity. Given the excess capacity that remains against current levels of demand, it seems unlikely that carriers have simply stopped folding operations. We’ll receive updates to February’s Long Distance Truckload employment numbers next week, which is a much-preferred gauge of capacity trends, although on a two-month delay.

Carriers we’ve spoken to continue to believe that more authorities are coming out of the market, and soon, as carriers are barely hanging on in the current environment.

Again, it seems unlikely that April will see strengthening demand given historical trends, and the current amount of supply remains in excess of freight volumes today

Regional Market Trends for this Week

What’s happening regionally? Reefer markets will further tighten in Miami next week, with Southern Georgia poised to feel some of this impact by mid-April as well. This will have an impact on dry van capacity as well, but dry van typically does not feel the larger pinch until mid-May. Of course, we could see an influx of imports moving via truckload hit the Savannah market in late April/early May, which would cause the grip of this market to tighten earlier.

Border regions of Texas are warmer to start the month, and will heat up to end the month. But these regions will be cool in mid-April.

Los Angeles is receiving back-to-back weeks of 100,000+ inbound TEUs. Though last year’s pattern suggests weakness in April, this year it appears that capacity will be tighter.

Midwest markets will continue to be dormant, and East Coast markets would historically be dormant. But, due to the Port of Baltimore closure, this is not totally certain.

Gulf Coast/Houston markets that had tightened due to front-loading ahead of the end of the quarter are expected to revert to a cooler status.

Top 3 Charts for the Week

Expect the NTIL to Drop

The NTIL has been flat since March 13, as well as YoY. Look for this metric to drop in April, which is typically a softer month.

The OTVI Shows Growth

While the OTVI reflects stronger freight volumes YoY, a larger share of that freight is moving by rail in 2024.

Excess Capacity Remains

As we kickoff April, it’s clear that supply continues to exceed demand.

Get Up to Speed with Weekly Market Intel

What’s going on this week in the US logistics market? Follow the Redwood LinkedIn page to watch Christopher Thornycroft’s insightful Redwood Rundown video every Tuesday. You can also read our insights blog to learn about industry trends and gain intel, including the weekly Redwood Report!